admin / June 8, 2022

White Paper from SVN — Leaving Money on the Table

Time’s Up for Non-Cooperation in CRE

leaving money on the table

By Kevin Maggiacomo

The clock is ticking on what is a systemic issue in commercial real estate investment sales: Non-cooperation and misaligned incentives create a loophole where brokers’ interests take precedence over sellers’ interests, resulting in an environment where most sellers are selling for less than fair market value. This model and way of doing business means that money is being left on the table by brokers and, more importantly, their clients.

In this white paper, we argue that:

- Today’s typical way of selling CRE assets is illogical and driven by misaligned incentive structures, instead of sound economic principles

- The CRE industry urgently needs to embrace cooperation to drive shared value in the future

- Cooperating proactively with the brokerage community is the most effective way to increase demand for CRE assets on the market

- Savvy brokers have the chance to embrace efficient, modern, and informed ways of working to achieve the best price and the best terms for their clients. We should know — SVN has been working like this for over 36 years.

Read the full White Paper Here (click to download)

Leaving Money on the table

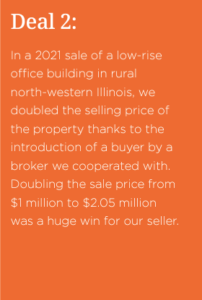

For the most part the CRE industry resists brokerage cooperation and fee sharing. A study we carried out spanning 10 years and 10 states showed that only one in six of the 15,000+ CRE deals surveyed was clearly cooperative*. Instead, in almost 85% of CRE transactions, listing brokers do not market to other brokers at all, miss out on all their relationships, and wind up producing the buyer on their own – referred to as a “double-ended” deal.

Indeed, today most brokers do the exact opposite of the companies mentioned earlier. Instead of tapping into the power of the network and distribution channel of the industry (i.e., the 100,000 brokers who exist within it) through cooperation, they actively work to shut this down, only exposing their sellers’ properties to a fraction of the potential buyers in the market. Looking at this through the lens of the supply and demand principle, this means that demand is reduced, sales prices are unlikely to be optimized, and will certainly not result in a fair, achievable, market rate. Undoubtedly money is being left on the table by both CRE brokers, and more importantly, their clients.

What is driving this clearly illogical behavior by the CRE industry? In an industry where you eat what you kill, surely any opportunity to drive up the sales price should be eagerly grasped? A happy seller means a long-term relationship and more deals down the line.

However, the undeniable logic of supply and demand goes head-to-head with a misaligned incentive structure. Far from ensuring that listing brokers and their sellers are on the same team, the current incentive structure puts them at loggerheads. And further, it disincentives cooperation and the ability to reach accurate, fair market prices more often and more easily, thanks to the power of the network.

MONEY IS BEING LEFT ON THE TABLE BY BOTH CRE BROKERS, AND MORE IMPORTANTLY, THEIR CLIENTS

*The 9.6% report: A report on the pricing advantage of cooperation*

Stay tuned for a new featured topic each week:

- The law of supply and demand

-

Leaving money on the table

- The unfortunate power of misaligned incentives

- What does cooperation look like? & What do SVN® franchisees say about cooperation in CRE?

- Why now? & What you need to know

About SVN

The SVN® brand was founded in 1987 out of a desire to improve the commercial real estate industry for all stakeholders through cooperation and organized competition. SVN is now a globally recognized commercial real estate brand united by a shared vision of creating value with clients, colleagues and our communities. When you choose SVN, you mobilize the entire SVN organization of experts and all our trusted relationships to act on your behalf. This shared network is the SVN Difference. To learn more, visit our website, www.svn.com.

« Previous Next »